Things To Avoid After You Apply for a Mortgage

Some HighlightsOnce a lender has reviewed your finances as part of the homebuying process, you want to be as consistent as possible. Don’t make any big changes that could affect your mortgage application.Here are a few tips. Don’t change bank accounts or apply for new credit. And this one may surprise you, don’t buy appliances or furniture for your next home yet either.The best tip of all? Before you do anything financial in nature, talk to your lender first.

Read MoreThings To Avoid After You Apply for a Mortgage

Some HighlightsOnce a lender has reviewed your finances as part of the homebuying process, you want to be as consistent as possible. Don’t make any big changes that could affect your mortgage application.Here are a few tips. Don’t change bank accounts or apply for new credit. And this one may surprise you, don’t buy appliances or furniture for your next home yet either.The best tip of all? Before you do anything financial in nature, talk to your lender first.

Read MoreThings To Avoid After You Apply for a Mortgage

Some HighlightsOnce a lender has reviewed your finances as part of the homebuying process, you want to be as consistent as possible. Don’t make any big changes that could affect your mortgage application.Here are a few tips. Don’t change bank accounts or apply for new credit. And this one may surprise you, don’t buy appliances or furniture for your next home yet either.The best tip of all? Before you do anything financial in nature, talk to your lender first.

Read MoreThings To Avoid After You Apply for a Mortgage

Some HighlightsOnce a lender has reviewed your finances as part of the homebuying process, you want to be as consistent as possible. Don’t make any big changes that could affect your mortgage application.Here are a few tips. Don’t change bank accounts or apply for new credit. And this one may surprise you, don’t buy appliances or furniture for your next home yet either.The best tip of all? Before you do anything financial in nature, talk to your lender first.

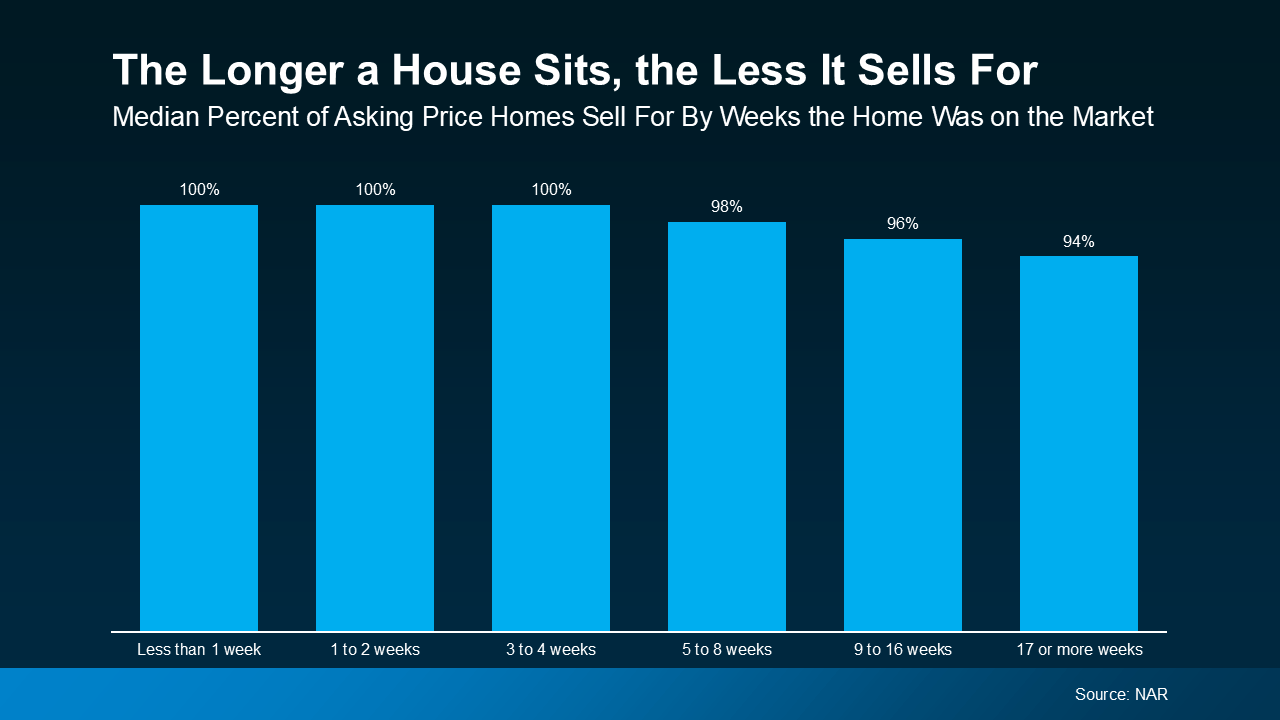

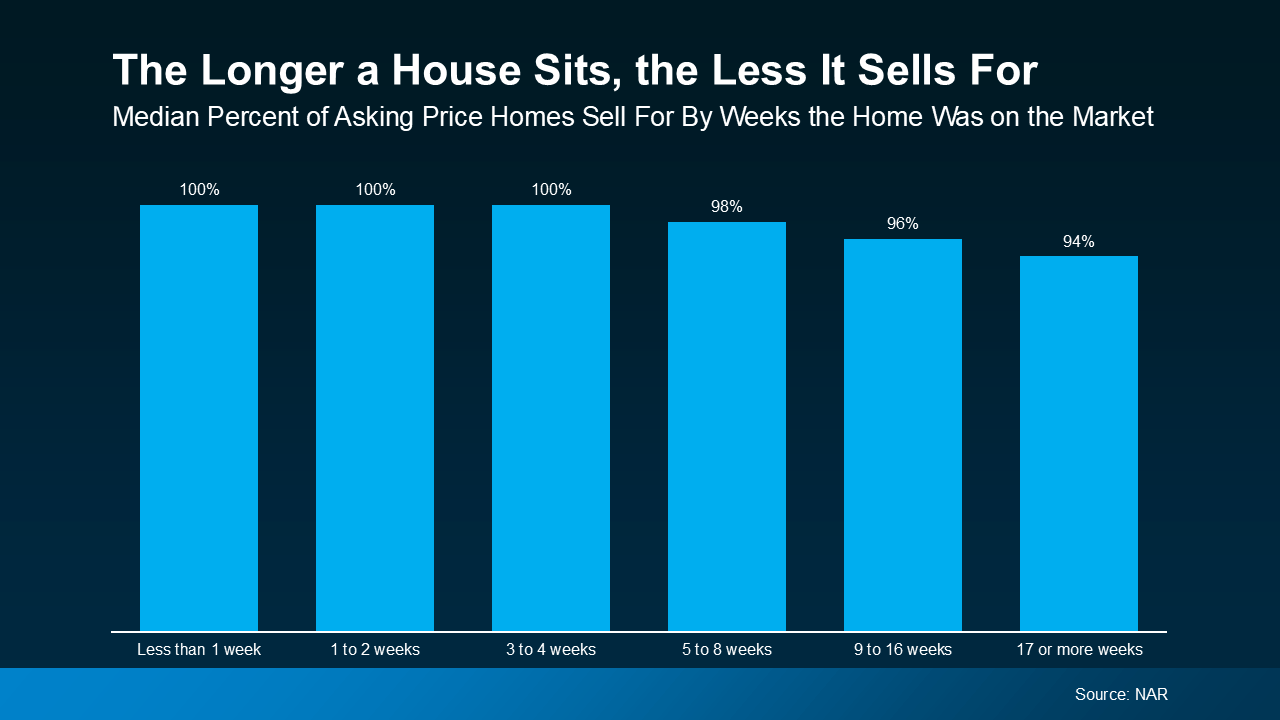

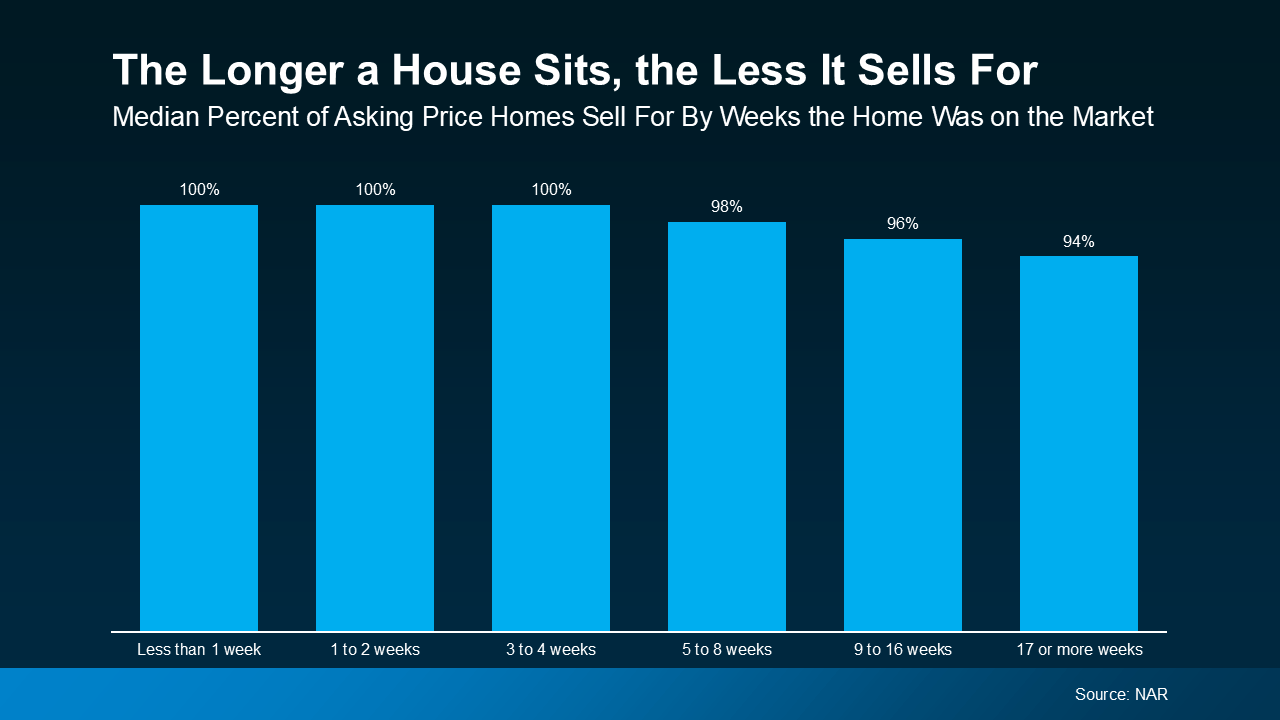

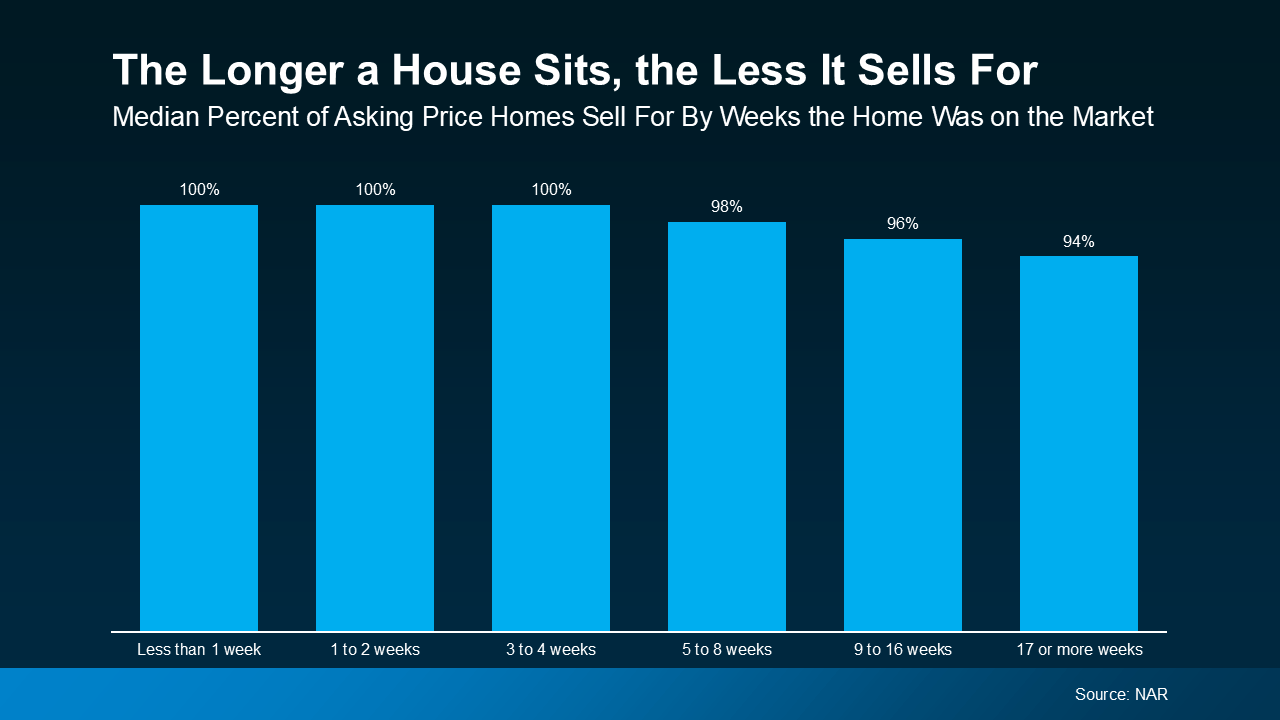

Read MoreThe #1 Thing Sellers Need To Know About Their Asking Price

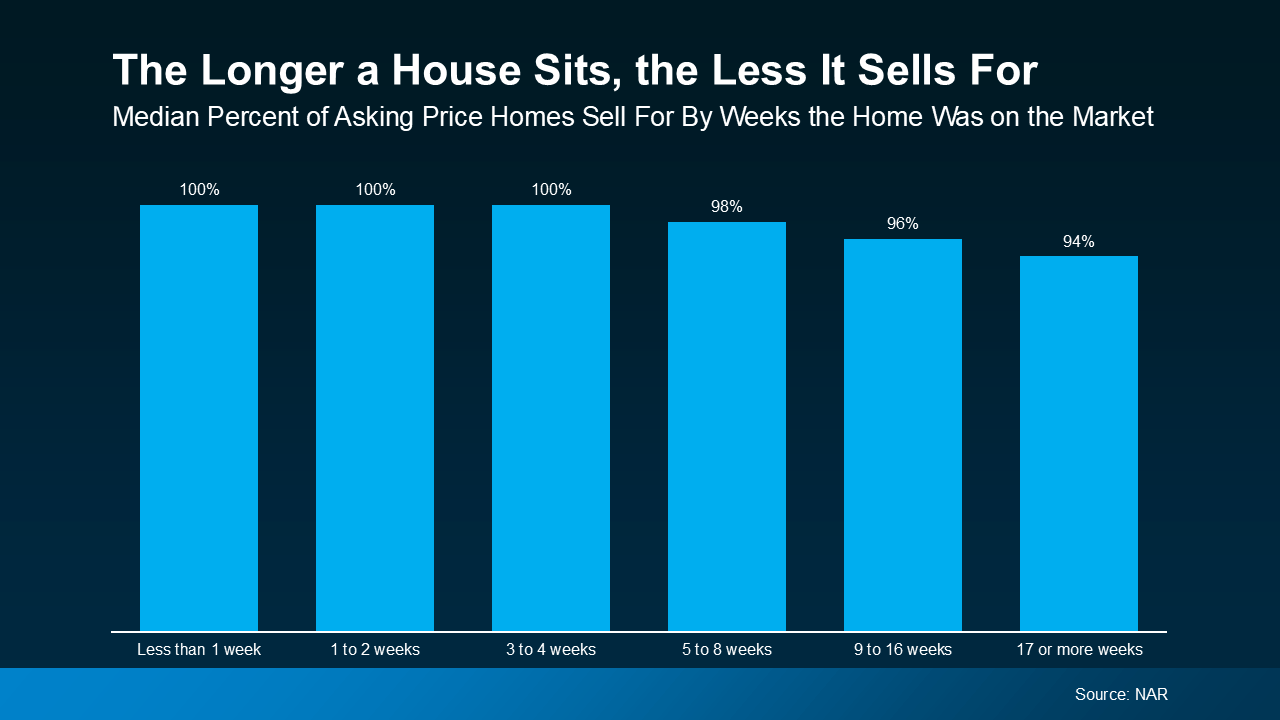

When you put your house on the market, you want to sell it quickly and for the best price possible; that's generally the goal. But too many sellers are shooting too high right now. They don’t realize the market has shifted as inventory has grown. The side effect? Price cuts are on the rise, but they really don’t have to be. Here’s why.According to data from Realtor.com, in February, price cuts were the highest they’ve been in any other February since 2019 (see graph below):If you consider...

Read MoreThe #1 Thing Sellers Need To Know About Their Asking Price

When you put your house on the market, you want to sell it quickly and for the best price possible; that's generally the goal. But too many sellers are shooting too high right now. They don’t realize the market has shifted as inventory has grown. The side effect? Price cuts are on the rise, but they really don’t have to be. Here’s why.According to data from Realtor.com, in February, price cuts were the highest they’ve been in any other February since 2019 (see graph below):If you consider...

Read MoreThe #1 Thing Sellers Need To Know About Their Asking Price

When you put your house on the market, you want to sell it quickly and for the best price possible; that's generally the goal. But too many sellers are shooting too high right now. They don’t realize the market has shifted as inventory has grown. The side effect? Price cuts are on the rise, but they really don’t have to be. Here’s why.According to data from Realtor.com, in February, price cuts were the highest they’ve been in any other February since 2019 (see graph below):If you consider...

Read MoreThe #1 Thing Sellers Need To Know About Their Asking Price

When you put your house on the market, you want to sell it quickly and for the best price possible; that's generally the goal. But too many sellers are shooting too high right now. They don’t realize the market has shifted as inventory has grown. The side effect? Price cuts are on the rise, but they really don’t have to be. Here’s why.According to data from Realtor.com, in February, price cuts were the highest they’ve been in any other February since 2019 (see graph below):If you consider...

Read MoreThe #1 Thing Sellers Need To Know About Their Asking Price

When you put your house on the market, you want to sell it quickly and for the best price possible; that's generally the goal. But too many sellers are shooting too high right now. They don’t realize the market has shifted as inventory has grown. The side effect? Price cuts are on the rise, but they really don’t have to be. Here’s why.According to data from Realtor.com, in February, price cuts were the highest they’ve been in any other February since 2019 (see graph below):If you consider...

Read MoreTownhomes: A Smart Solution for Today’s First-Time Buyers

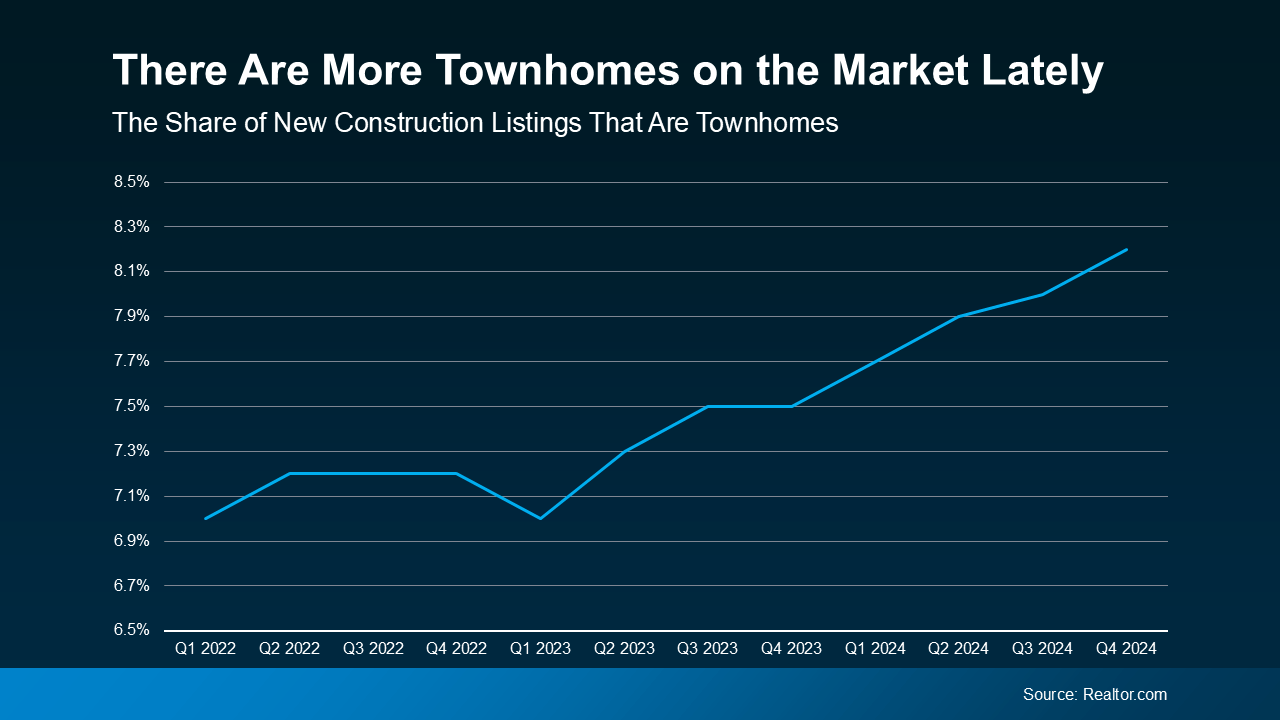

Buying your first home in today’s market can feel tough. Between high home prices and mortgage rates, affordability is still a big challenge. And some buyers are making one simple trade-off that’s getting them in the door faster: square footage.According to the National Association of Home Builders (NAHB), 35% of buyers are willing to purchase something smaller to make homeownership happen. And one place you can usually find a smaller footprint (and sometimes better affordability) is in townhomes.Why...

Read More